how to file back taxes yourself

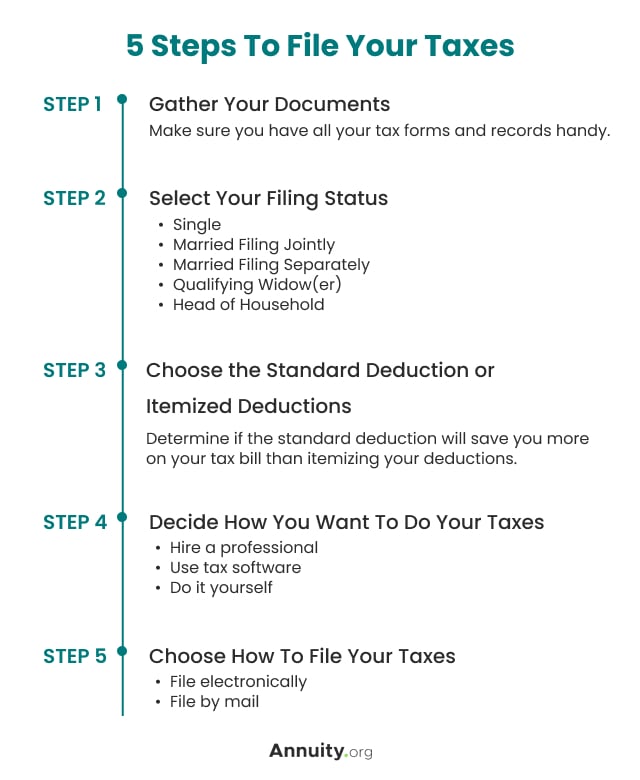

Filing a tax return for a previous year isnt as hard as you may think but it does require a few steps. To file back taxes start by determining which years you need to file and locating the W-2s 1099s or 1098s associated with those years.

2022 Tax Day Filing For A Tax Extension Here S How That Works And When Your Taxes Are Due Nbc Chicago

You cant file your tax return until youve received a Form W-2 or Form 1099 from every place you have worked during the year.

. Apply for an Employer ID Number EIN Check Your Amended Return Status. If you decide to file self-employment taxes yourself or are gathering paperwork for your accountant youll need the following forms. First you need to gather your tax documents from the missing year s including all W-2s and 1099 forms that.

The IRS may file a return for you. You can also call the IRS but the wait. Download the proper tax forms for the year.

Next you can manually complete the. Get relief from the IRS. A payment plan will allow you to pay back your overdue tax.

Get our online tax forms and instructions to file your past due return or order them by calling 1-800-Tax-Form 1-800-829-3676 or 1-800-829-4059 for TTYTDD. See if you Qualify for IRS Fresh Start Request Online. We work with you and the IRS to settle issues.

- As Heard on CNN. When it comes time to file you will use those documents to fill. Find pros you can trust and read reviews to compare.

You can also file IRS Form 9465 the Installment Agreement Request with your tax return regardless of how much you owe. Connect With An Expert For Unlimited Advice. Prepare File Prior Year Taxes Fast.

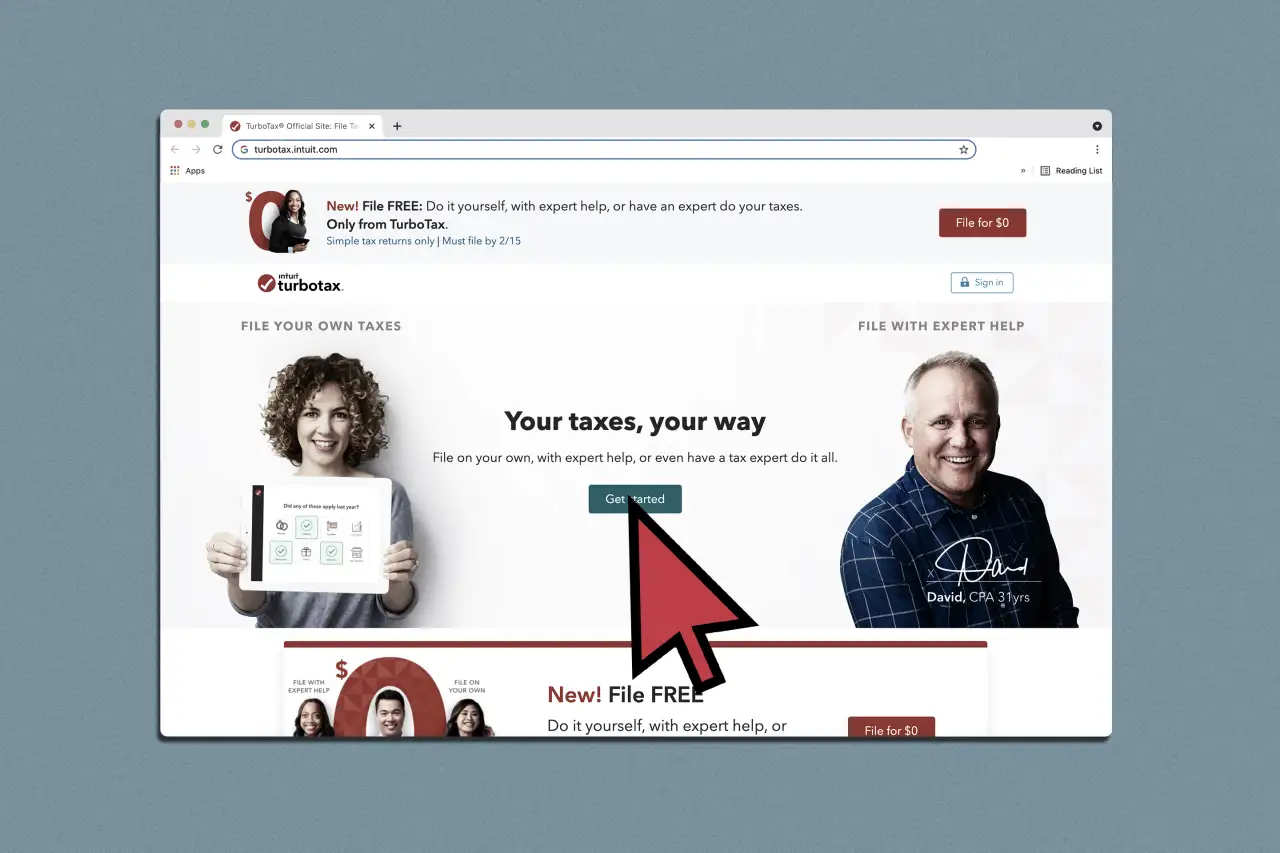

Solve All Your IRS Tax Problems. Give the IRS your name Social Security number and contact data. If you are asking about preparing and filing a tax return for a prior year you can buy and download TurboTax for the year that you want to file back to 2013.

Make this request either. Get Your Tax Record. Ad BBB A Rating.

- As Heard on CNN. Get an Identity Protection PIN IP PIN. Solve All Your IRS Tax Problems.

3 Should you file your tax returns if you cant pay the taxes. Under an installment agreement a taxpayer pays the amount due over a period of time. Outfit the business name telephone number and address.

Form 1040 also known as your US. Back taxes are the taxes you failed to file. Gather the correct tax documents and other information.

To file back taxes youll need to purchase the edition of HR Blocks software for the year or years that you need to file. File Your Taxes for Free. Non-employment compensation royalties and other miscellaneous income on 1099-MISC.

Take Avantage of IRS Fresh Start. Even if you cant afford to pay taxes you owe in full always file your return as soon as you can. If you are missing records to correctly file your back taxes the transcript you want.

The IRS contacting you can be stressful. Basically taxpayers have three options for paying back taxes. Ad Dont Know How To Start Filing Your Taxes.

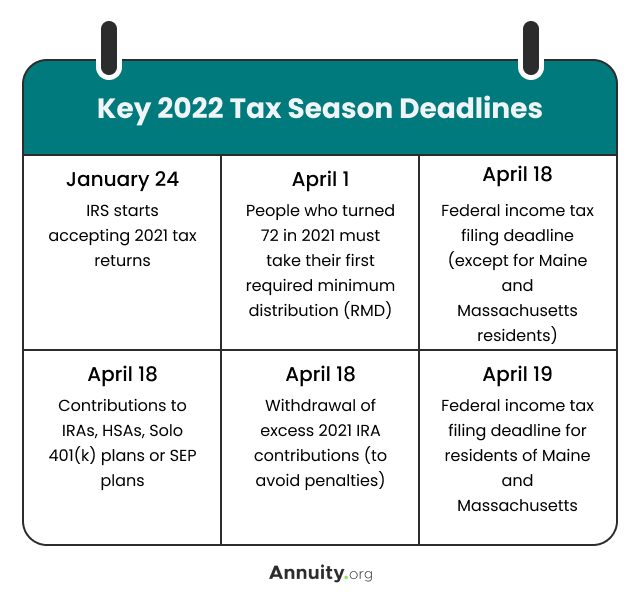

Ad Quickly End IRS State Tax Problems. If you have several past-due returns to file the IRS normally requires that you file returns for the current year and past six years. When you have not filed your taxes on time you will need to file back taxes.

Then you can request an additional 60 to 120 days to pay. Ad BBB A Rating. 4 Step 1 Get your wage and income transcripts from the IRS.

But your specific facts and IRS rules will determine how far. If you want to tackle filing your back taxes by yourself choose a reputable tax software company to assist you. Make your best gauge of the wages you.

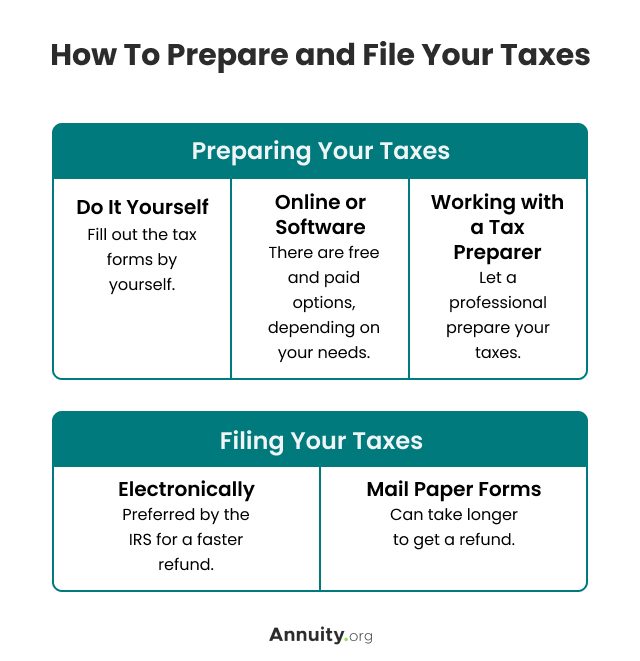

Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. Get Your Qualification Analysis Done Today. Determine how youll file your back taxes.

If you need more time to pay your tax bill the IRS will probably give it to you in the form of a payment plan. Contact the IRS for Tax Filing Questions. Start with a free consultation.

The first step is gathering any information from the. Download previous years tax forms. Since tax laws change year.

Ad Need help with Back Taxes. It is illegal to ignore your taxes and it is a must to file the. 5 Step 2 Prepare and file your tax returns.

Ad Owe back tax 10K-200K. For personal returns you will need any and all T-slips such as T4s and T5s. If you are self-employed you will not be able to get a copy of your income earned from the IRS.

Owe IRS 10K-110K Back Taxes Check Eligibility. If you are missing any slips or are unsure if you have them all you. Ad Real prices from local pros for any project.

Quickly Prepare and File Your Back Taxes with Simple Step-by-step Guidance. The IRS charges a fee for the installment. For example if you did not file 2015.

Ad Always Free Always Simple Always Right. The software tells you whether itemizing your deductions or claiming the standard deduction will save you the most money taking the guesswork out of this process. Prices to suit all budgets.

For the fastest information the IRS recommends finding answers to your questions online. For example you can find a number of prior year 1040. An offer in compromise.

To e-file back taxes with HR Block you can purchase HR Block. Be prepared to pay fees or penalties.

Filing Back Taxes What To Know Credit Karma Tax

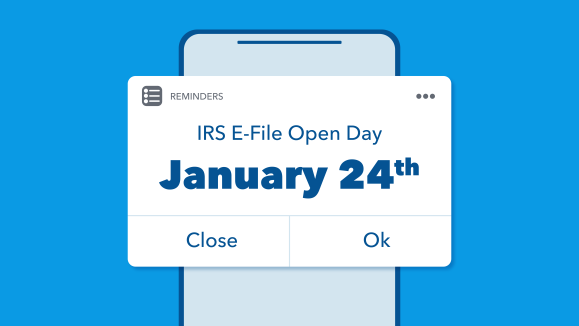

Irs Announces E File Open Day Be The First In Line For Your Tax Refund The Turbotax Blog

American Tax Returns Don T Need To Be This Painful The Atlantic

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide

3 Ways To File Just State Taxes Wikihow

2022 Filing Taxes Guide Everything You Need To Know

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

3 Ways To File Your Taxes For Free Forbes Advisor

2022 Filing Taxes Guide Everything You Need To Know

Best Way To Catch Up On Unfiled Tax Returns Back Taxes

Tax Season 10 Tips For Doing Your Taxes Yourself

How To File An Extension For Taxes Form 4868 H R Block

How To File Taxes For Free Turbotax 2022 Free File Change Money

Ways To File Taxes For Free With H R Block H R Block Newsroom

Unfiled Tax Return Information H R Block

2022 Filing Taxes Guide Everything You Need To Know